Significant growth in TV OTA, TV Digital, and CTV/OTT fueled by political and other local…

BIA Revises Local Radio Advertising Estimates Down to $12.8 B in 2020 Due to Pandemic; Transition to Digital Accelerating

New forecasts available for all Radio Markets in BIA ADVantage, MEDIA Access Pro and Investing In Radio Market Report, 1st Edition 2020

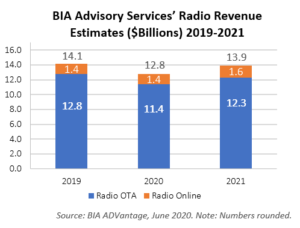

CHANTILLY, Va. (June 25, 2020) – BIA Advisory Services has reduced its early second quarter 2020 forecast for U.S. local radio advertising due to the impact of the pandemic on the national economy. The new revenue estimate is $12.8 billion, broken down to $11.4 billion for over-the-air revenue and $1.4 billion for digital revenue (including local advertising sold by streaming companies), compared with the $14.3 billion combined forecast earlier this year.

By comparison, in 2019 local radio stations generated $12.8 billion in over-the-air revenue and just over $1 billion in digital. This was a -1.6 percent decrease in total revenue from 2018. The 2020 revenue estimate indicates a -10.7 percent decrease in over the air advertising revenue from 2019. One area of growth for radio is in digital. According to the latest Share of Ear® update from Edison Research, a portion of AM/FM radio listening online hit 10 percent for the first time in May.

“In 2018, we projected that radio’s digital platforms would reach $1 billion by 2019 and last year the industry hit this mark,” said Mark Fratrik, SVP and Chief Economist, BIA Advisory Services. “For 2020, our ad forecast shows that digital sales, including streaming, will stay steady. Then by 2021, Radio online[1] revenue will start to climb back up again. On the over-the-air side, we see a bigger COVID hit, with a steep drop in 2020 and some recovery back by 2021.”

BIA’s analysis reveals the following verticals will spend the most on radio in 2020:

BIA’s analysis reveals the following verticals will spend the most on radio in 2020:

- Finance/Insurance $2.00 B

- Retail $1.97 B

- Automotive $1.50 B

- Technology $1.30 B

These industries may benefit from the continuing shift in radio listening from the car to the home as at-home audio environment features give consumers multiple opportunities to consume promotions. Streaming has become a major growth opportunity for broadcasters to maintain existing audiences and attract new, younger listeners. BIA’s revenue estimate drops to $12.5 billion when streaming ad revenue is not included.

“Audiences are spending more time on streaming and podcasting in ways they haven’t in pre-pandemic times,” said Rick Ducey, BIA managing director. “These new audio habits are likely to take root and grow over time and advertisers will look to all platforms to promote their message. Radio sellers who see and respond to the audience and advertiser acceleration to digital audio with new formats, content and appeal for different demo groups will see better than average performances.”

Accessing BIA’s Local Radio Market Forecasts

BIA’s Local Radio Market Forecasts have been published in BIA ADVantage that now provides enhanced local radio market profiles and station data. BIA ADVantage delivers easy access to BIA’s extensive local market estimates and forecast data, along with expert insights and analytics on local traditional and digital advertising. ADVantage clients can login now to view their local market data.

Other resources to access BIA’s Local Radio Market Forecasts include BIA’s Media Access Pro™, a data and analytical service that delivers comprehensive information on the broadcasting and publishing industries, and Investing In® Radio Market Report, 1st Edition 2020.

For a detailed analysis and guide of all owners in the Nielsen Audio rated markets and non-rated markets, BIA has also just published Investing In Radio® 2020 Ownership Report.

[1] BIA defines Radio Online as, “Online radio advertising includes local advertising sold by local stations (streaming and website advertisements) and pure play streaming services. Includes the share retained by local radio stations after reselling other online platforms (e.g., Google AdWords).”